Embracing the Spirit of Giving: A Joyful Partnership with UGM

Dear Valued Clients,

As we approach the festive season, we find joy in coming together to make a positive impact on the lives of those less fortunate. This week, we are delighted to share a heartwarming initiative that embodies the true spirit of the holidays.

In collaboration with Fidelity Investments, we are excited to announce a joint donation of $2,000 to the UGM. UGM is dedicated to transforming communities by addressing the challenges of poverty, homelessness, and addiction, one life at a time. Their commitment to providing shelter, support, and nourishment to those in need aligns perfectly with our values.

This holiday season, as we gather with our loved ones, it's important to acknowledge that not everyone is privileged to experience the same warmth and abundance. Through our partnership with UGM, we aim to make a meaningful difference in the lives of individuals facing hardships during these festive times.

The $2,000 donation will directly contribute to UGM's efforts in feeding the homeless by the tens of thousands each year, providing vital resources and support to those on the journey to rebuilding their lives. At WealthViser Private Wealth, we believe in practicing what we advise, and giving back is an integral part of our commitment to holistic financial planning.

We extend our sincere thanks to all our clients for being an essential part of this initiative. Your trust and partnership empower us to make a positive impact in the communities we serve.

As we reflect on the past year and look forward to the possibilities that the new year brings, let us continue to come together and create a ripple effect of kindness and generosity. Your ongoing support enables us to make a real and lasting difference, and for that, we are truly grateful.

Wishing you and your loved ones a joyous holiday season filled with warmth, love, and the spirit of giving.

Warm regards,

Franco Caligiuri

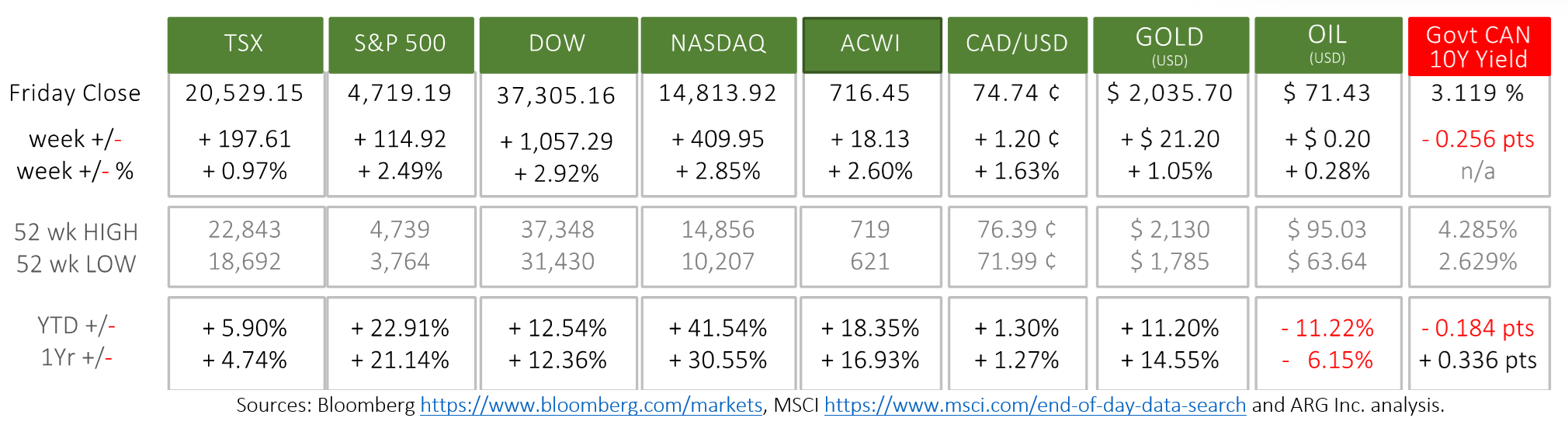

Last Week in the Markets: December 11th – 15th, 2023

What happened last Week?

U.S. equity indexes rose for the seventh consecutive week adding another 2½ to 3%. The Dow set a new record high that bested the previous peak of January 4th, 2022, nearly two years ago. The S&P 500 is about 1% its all-time high, and the NASDAQ is 8% short of its high-water mark. The TSX has not been as consistent as its American peers but has risen 9.6% over the same seven-week period, 8% under its peak.

Monetary policy releases encouraged this equity positivity. On Wednesday the U.S. Federal Reserve kept its target range for the federal funds rate at 5¼ to 5½ percent. The announcement began, “ Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.” The interest rate announcement also included the Fed’s Summary of Economic Projections. The Fed predicts that the Personal Consumption Expenditures Price Index will fall to 2.4% next year, 2.2% by 2025 and reach its 2% target by 2026. Accordingly, the rate setting committee’s “dot plot” forecasts three interest rate cuts of ¼ percent in 2024. Fed press conference and documents CNBC and Fed rate cuts CNBC and Fed Announcement

Elsewhere, the Bank of England (BoE) and the European Central Bank (ECB) also kept their interest rates unchanged as they see their economy cooling, job demand falling, and consumer prices rising in the short term. ECB release BoE rates

Just prior to the Fed’s announcement the U.S. Bureau of Labor Statistics reported November’s Consumer Price Index. Prices rose 0.1% last month and 3.1% over the past year. November’s monthly inflation rose from October, but the annualized rate of inflation ticked down. BLS release

What’s ahead for this week and beyond?

In Canada, the new housing, raw materials, and producer price indexes will be released. On Tuesday StatsCan will report November consumer prices.

In the U.S., building permits, housing-starts, new and existing home sales will be announced, and the National Association of Home Builders will release its housing market index. Third-quarter Gross Domestic Product (GDP) estimates will arrive on Thursday. The Federal Reserve’s primary inflation indicator, Personal Consumption Expenditures Price Index (PCE) will be reported on Friday.

Globally, the Eurozone will report its Harmonized Index of Consumer Prices (HICP) for November. Japan will announce its imports, exports, and trade balance. The U.K. will release its consumer, producer, and raw materials price indexes.