Protecting Yourself: Avoiding Scams, Online Theft, and Safeguarding Your Data

Far too many older adults fall prey to scammers seeking to make a quick buck. To help you stay safe and avoid scams and swindles, here are some important tips.

The Canadian Anti-Fraud Centre (CAFC) reports a concerning increase in seniors falling victim to fraud scams over the last three years, with corresponding dollar losses on the rise. In 2022 alone, 1,177 emergency scams were reported in Ontario, resulting in a staggering $5.4 million in losses.

Protecting Your SIN (Social Insurance Number)

Your SIN is a valuable piece of information, and protecting it is crucial. According to the CAFC, identity fraud cases are on the rise, with over 19,000 Canadians reporting incidents in 2013 (last year of available data), resulting in losses exceeding $11 million. To safeguard your SIN:

- Only provide your SIN when legally required (e.g., to your employer, financial institution, or relevant government agency).

- Store your SIN card and related documents in a secure place (not in your wallet).

- Shred documents containing your SIN; do not dispose of them in recycling bins.

- Take immediate action if you suspect fraudulent use of your SIN, including filing a report with the police and the Canadian Anti-Fraud Centre.

If someone is using your SIN, change passwords, especially for financial or government institutions, review credit reports, and place a credit fraud alert.

Additional Measures from WealthViser Private Wealth – Your Trusted Financial Wealth Management Firm:

In our commitment to enhancing digital security, WealthViser Private Wealth is updating procedures to further protect our valued clients. We are implementing a new measure where, in addition to email correspondence, we will call clients directly when a redemption request is submitted. This added layer of security aims to ensure the authenticity of such requests and protect our clients from potential unauthorized transactions.

Other Scams and Fraudulent Activities to Be Aware Of:

1. Health Insurance Fraud:

- Never sign blank insurance claim forms.

- Ask medical providers about charges and expected out-of-pocket expenses.

- Review insurer’s benefit statements carefully.

- Keep accurate records of healthcare appointments.

2. Telemarketing Scams:

- Avoid unfamiliar companies; check with the Better Business Bureau.

- Request written material about any offer or charity.

- Obtain detailed information about the salesperson and the business before transacting.

3. Home Repair or Contractor Fraud:

- Be an informed consumer; shop around before making purchases.

- Read contracts thoroughly and ensure all requirements are in writing.

- Understand contract cancellation and refund terms.

Bottom Line:

Don't hesitate to discuss these matters with someone you trust. You're not alone, and there are resources available to help, including local police, your bank, and your insurance carrier. Taking action is crucial in preventing further harm.

Franco Caligiuri

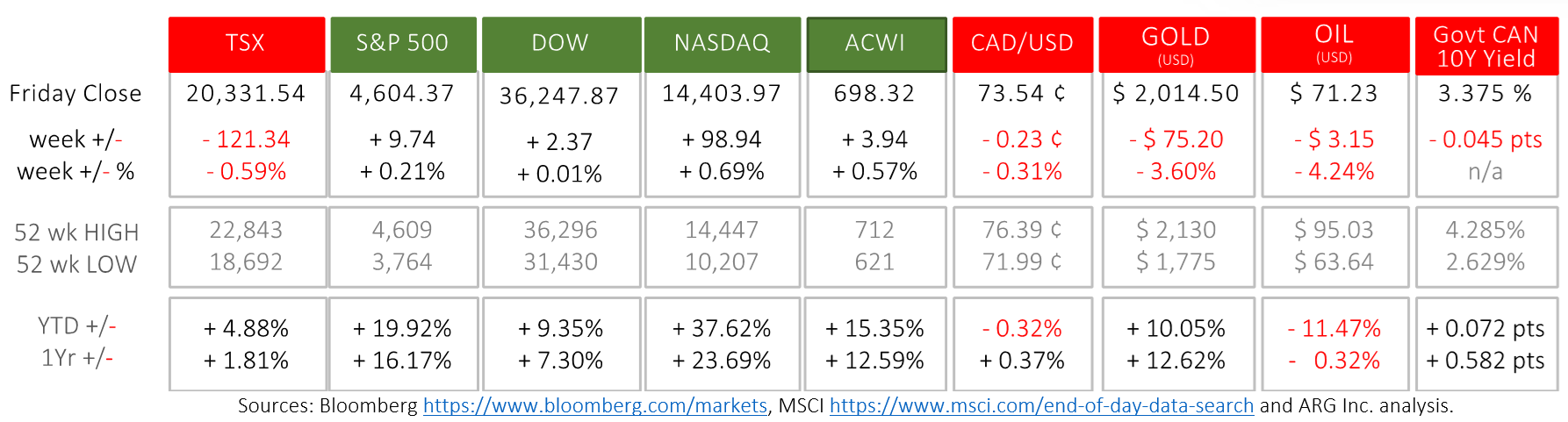

Last Week in the Markets: December 4th – 8th, 2023

What happened last Week?

The TSX lost ground, as all three major U.S. equity indexes gained for the sixth consecutive week. Oil fell for the seventh week, losing 19% ($16.85) since October 27th. Gold was lower for the week and had set a new 52-week high before settling back toward the $2,000/ounce level.

Tension had been rising for weeks as Wednesday’s Bank of Canada interest rate announcement approached. Based on economic announcements here and in the U.S. most analysts predicted that rates would be left unchanged. Despite these assurances any families with a mortgage renewing or still on a variable rate were attentive and concerned.

Thankfully, the consensus of experts was proved correct when the Bank held the policy interest rate, the overnight rate, unchanged at a target of 5%. The deposit rate (banks depositing to the Bank of Canada) and the bank rate (banks borrowing from the Bank of Canada) did not change, and they remain at 5% and 5¼%, respectively. BoC release CBC and BoC

On Friday the U.S. non-farm payroll report was released that showed employment in November rose by199,000 on a seasonally adjusted basis, which is an increase from 150,000 for October. Job increases occurred in healthcare (77,000), government (49,000), hospitality (40,000), and manufacturing (28,000). The unemployment rate ticked down 0.2% to 3.7% as the number of unemployed was unchanged at 6.3 million workers.

Over the past year an average of 240,000 jobs have been added each month in the U.S. Despite falling below this average, November’s healthy number of nearly 200,000 jobs showed the resiliency of the U.S. economy again. Analysts suggest that this rate of job creation will allow the Federal Reserve to maintain interest rates at their current level at their announcement next week, and also not require an increase as past rate adjustments work their way through the economy. BLS release CNBC and payroll report.

What’s ahead for this week and beyond?

In Canada, in a light week for economic announces building permits and housing starts, and foreign investment will be reported.

In the U.S., the Consumer Price Index (CPI) and Producer Price Index (PPI) are scheduled for release on Tuesday. On Wednesday the Federal Reserve will announce its latest monetary policy and interest rates.

Globally, China’s retail sales, industrial output, outstanding and new yuan loan growth, U.K.’s industrial and manufacturing output and construction spending, the Eurozone’s industrial production and wages, and Japan’s industrial output and capacity utilization are scheduled for release.